ITEL Labs: The Science of Unfair Settlement

ITEL Labs decision to cost policyholders and contractors fortunes is nothing shy of fraud and collusion.

Regarding property insurance and the restoration industry, there are laws to ensure that the policy matches the insured property as it once was before the loss. Let's explore what matching laws are, why they are essential, and how a subtle move by ITEL Labs is protecting the carrier from living up to their contractual obligation to make policyholders whole again.

These laws are essential because they help ensure homeowners are adequately covered and protected. You have seen how bad it can get if you are from a state without laws preventing the carrier from attempting to match. Frequently an Insurance company refuses to provide their customers with a uniform and continuous appearance after a loss. Attempting to "match" what was once there to the new materials used to repair the damaged areas. Luckily some states are starting to decide that this practice should be made illegal. Many still have no laws protecting policyholders from bad-faith insurance carriers who do not wish to cover their policyholders for a total replacement.

When you file a claim with your insurance company, they will typically send an adjuster to assess the damage to your property. The adjuster will determine the extent of the damage and what repairs or replacements are necessary. They will also determine whether the new materials used for repairs or replacement will match the existing ones. Their job is to bring you to where you once were before the loss. If your shingles had a uniform appearance to one another, then you are entitled to just that in your policy and not weathered shingles up against new ones.

The standard process is to send the materials to ITEL Labs if there is disagreement over 'like kind and quality.'

ITEL Labs claims to have developed a proprietary database of building materials to identify what should be used to repair a policyholder's home. It once helped to ensure that the replaced items had the same quality and appearance as the original. They were the go-to source for material identification for as long as I have been in this industry.

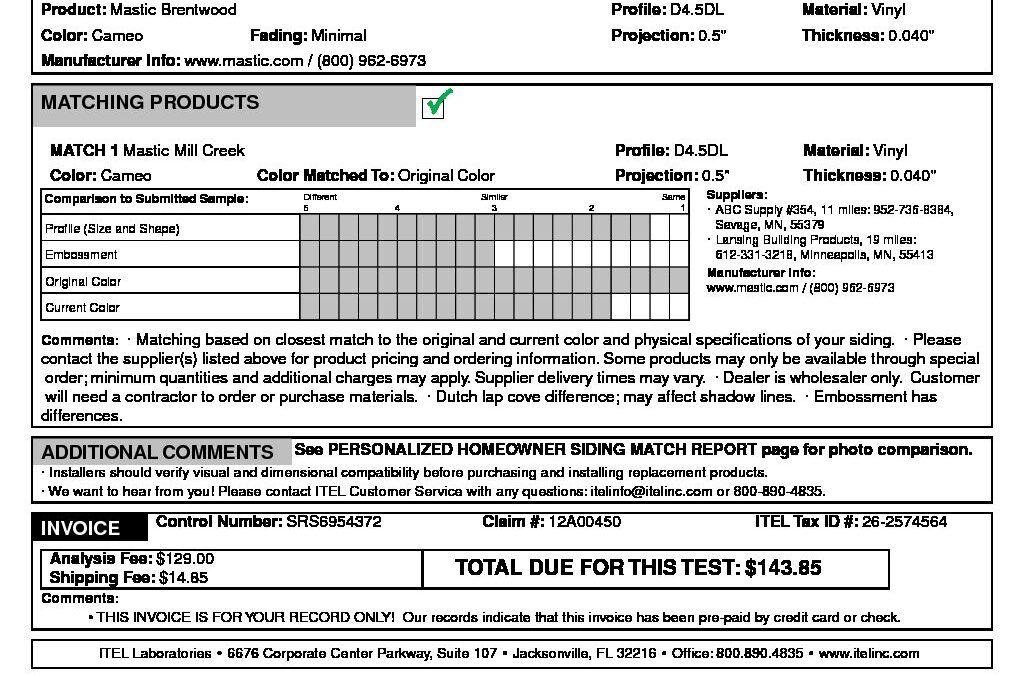

Here is what a report looked like in 2019.

It was a valued service.

Something happened, though. ITEL started to remove that green check mark, and those bars that show how close the material in question can be matched disappeared. Oddly enough, this happened as new CEO Bob Logan took over at ITEL Labs.

Bob is a busy guy. Not only was he in charge at ITEL, but he also ran a company called Global Claims Service at the same time. What does GCS do?

The way they describe themselves is as follows:

"Global Claims Services (GCS) is an insurance service provider whose mission is to help property insurance companies. effectively settle claims worldwide. GCS is committed to custom-fitting its service offering to meet the unique needs of each international insurance market. GCS helps property insurance companies settle claims in the United States, Canada, and the UK via independent subsidiary companies."

What does that mean? Who knows. They just put buzzwords in an automatic generator and hit go. They assist insurance companies, which is what it boils down to.

Bob Logan, alongside others at Global Claims Service, decided to cost policyholders and contractors countless dollars that were rightfully theirs. Instead, they gave it back to their friends in the P/C Insurance industry.

How?

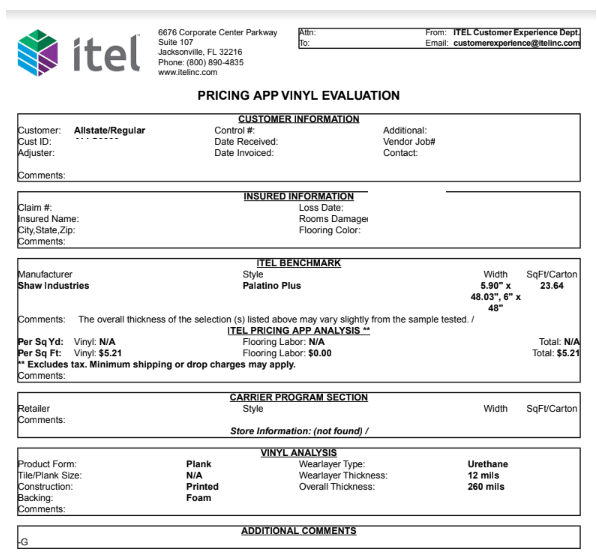

This is what an ITEL Report looks like today.

See what has been removed? No more green checks or bars that note how close a match the material in question is.

Why does this matter? Because now, as an insurance company, I can say, "Here is the match ITEL provided," even if it doesn't match at all. If you send in 45-year-old siding that's burnt up, ITEL will provide you with a match nonetheless. Today will be the closest material they could find on the market to what was "tested."

Sort of like going to Home Depot and asking a random guy working there, "You got anything that looks sort of like this?"

Now, instead of paying out all 4 sides of the house when the siding gets blown off, the carrier only has to pay for one, claiming they had provided the contractor and policyholder a good match and taking what was once a $40,000.00 estimate to $8,000.00 based on ITEL's report.

I've personally had this happen. I remember when a State Farm Claims Specialist sent me an email, and all it had in it was the names of 3 different shingle brands. Just words on a page, nothing else. He advised me that was the report, and he couldn't disclose any more than that. I sent him back the report that said "No match found" on a Word document. Things didn't get any more cordial from there.

That's a lot of money lost in one job. Now multiply that by every claim in this country where the carrier attempts to "match" old materials to new ones.

After further investigation, it appears that ITEL is a subsidiary of Global Claims Service, as is ICC, which is a similar company used by our friends up north in Canada.

Per their website:

"Founded in Jacksonville, Florida in 1993, GCS has established itself as a leader in high-volume building component evaluation. In addition, GCS provides temporary housing assistance for policyholders who have lost the use of their homes. Through its widely deployed mobile technology platform, GCS delivers critical and timely assessments of damaged flooring, roofing, siding, and cabinetry. GCS services are delivered through the well-known brands of ITEL, Renovar, ICC, and Housing Headquarters."

Seeing the apparent conflict of interest in this matter doesn't take much thought.

Headquartered in Jacksonville ITEL is safe from any investigation from the Florida Insurance Commission, which was paid $74M over the last ten years in bribes...I mean "donations" from the insurance carriers. So they are about as useless as you can imagine.

So, what can you do?

If you're a restoration company, public adjuster, roofer, or GC, I would not send another piece of material to ITEL again. Never pay for another report.

If suppose you're a homeowner that has filed a claim and the insurance adjuster insists on matching your old siding to new using an ITEL labs report, you have good authority to refute that report due to this apparent conflict of interest the company has displayed.

Remember that $40,000.00 siding job that turned to $8,000.00? Imagine that was your home. Imagine it was your job. ITEL decided that the profit margins for their friends in the insurance industry took precedence. It was taking the money from your pocket and putting it back where they wanted it.

ITEL Labs Inc. refused to comment on this matter.